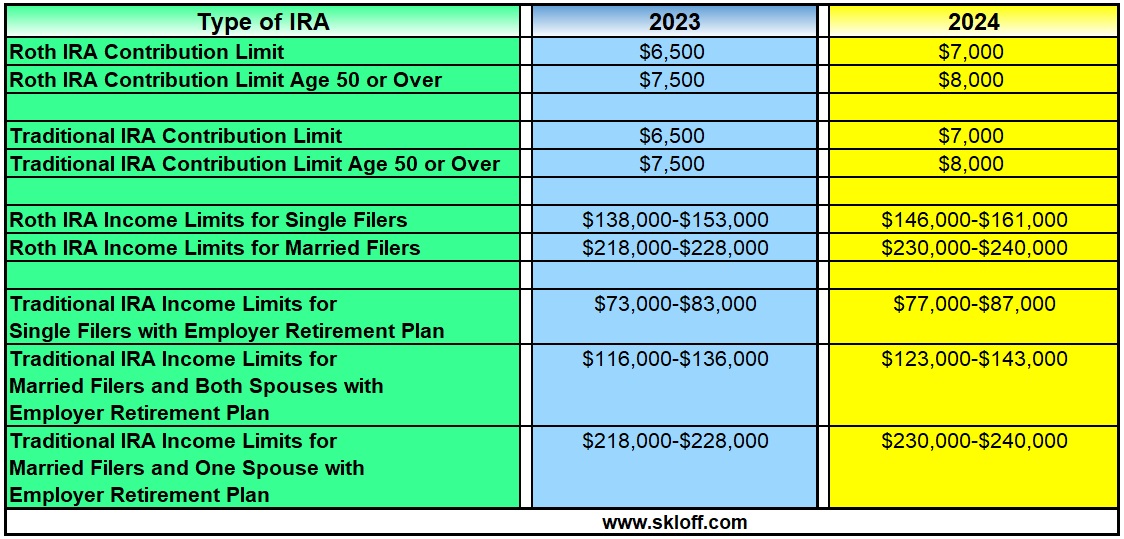

Simple Ira 2024 Contribution Limit Irs. Beginning in 2024, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for individuals age 50 or older). Ira contribution limits for 2024.

Beginning in 2024, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for individuals age 50 or older). To account for the increase, you may have to reevaluate your budget in.

The simple ira contribution limit for the 2023 tax year is $15,500, meaning employee salary deferral contributions may not exceed that amount per person.

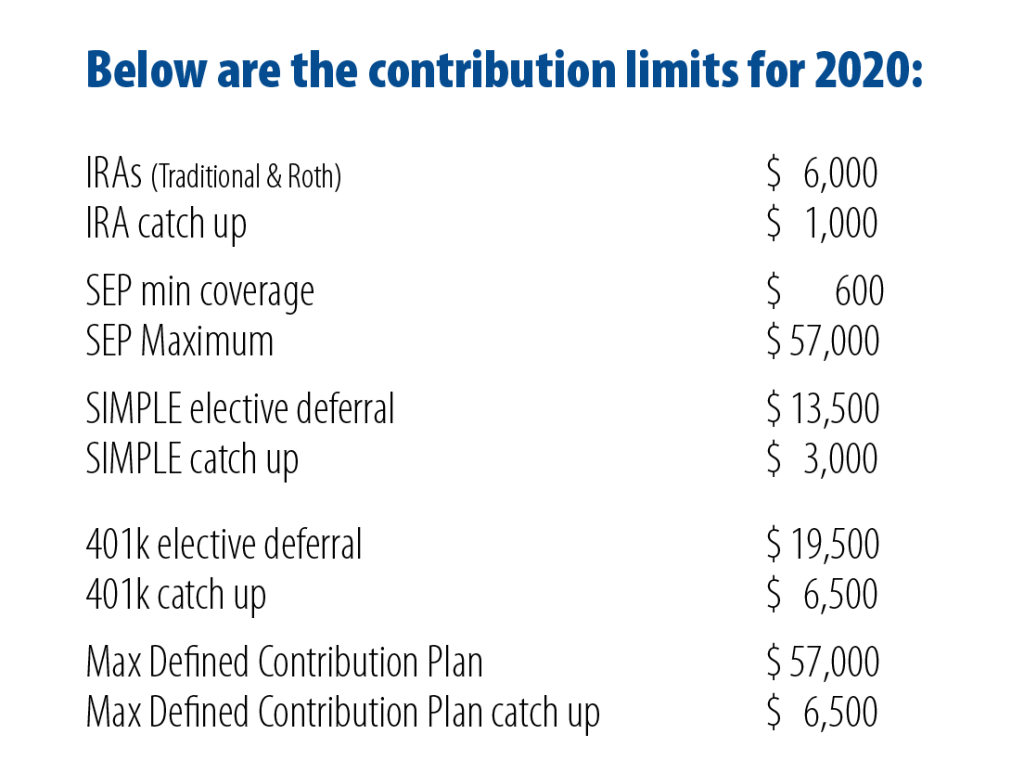

ira contribution limits 2022 Choosing Your Gold IRA, Like both of these plans, the simple ira is subject to annual contribution limits. The basic limit on elective deferrals is $23,000 in 2024, $22,500 in 2023, $20,500 in 2022, $19,500 in 2020 and 2021, and $19,000 in 2019, or 100% of the.

SIMPLE IRA Contribution Limits in 2022 Wealth Nation, The basic limit on elective deferrals is $23,000 in 2024, $22,500 in 2023, $20,500 in 2022, $19,500 in 2020 and 2021, and $19,000 in 2019, or 100% of the. Ira contribution limits for 2024.

IRA Contribution and Limits for 2023 and 2024 Skloff Financial, To account for the increase, you may have to reevaluate your budget in. For tax years starting in 2024, an employer may make uniform additional contributions for each simple plan employee to a maximum of the lesser of up to 10%.

Simple Irs Contribution Limits 2024 Dore Nancey, The ira contribution limits for 2024 are $7,000 for those under age 50, and $8,000 for those age 50 or older. The annual employee contribution limit for a simple ira is $16,000 in 2024 (an increase from $15,500 in 2023).

2024 Simple Ira Contribution Ilise Leandra, The simple ira contribution limit for employees in 2024 is $16,000. Ira contribution limits for 2024.

2024 Contribution Limits Announced by the IRS, Simple ira and simple 401(k) maximum contribution. Like both of these plans, the simple ira is subject to annual contribution limits.

Your 2020 Annual Contribution Limits Midatlantic IRA, 401 (k) and ira contribution limits are expected to increase by $500 for 2024. Employees 50 and older can make an extra $3,500.

Solo 401k Contribution Limits For 2020 & 2021 41C, Salary reduction contribution up to $16,000 ($19,500 if age 50 or over) 5. The annual employee contribution limit for a simple ira is $16,000 in 2024 (an increase from $15,500 in 2023).

Simple Ira Contribution Limits 2024 Over Age 50 Katya Melamie, Like both of these plans, the simple ira is subject to annual contribution limits. The simple ira contribution limit for the 2023 tax year is $15,500, meaning employee salary deferral contributions may not exceed that amount per person.

Roth Ira Contribution Limits 2024 Eilis Harlene, The ira contribution limits for 2024 are $7,000 for those under age 50, and $8,000 for those age 50 or older. The simple ira contribution limit for the 2023 tax year is $15,500, meaning employee salary deferral contributions may not exceed that amount per person.

The ira contribution limits for 2024 are $7,000 for those under age 50, and $8,000 for those age 50 or older.