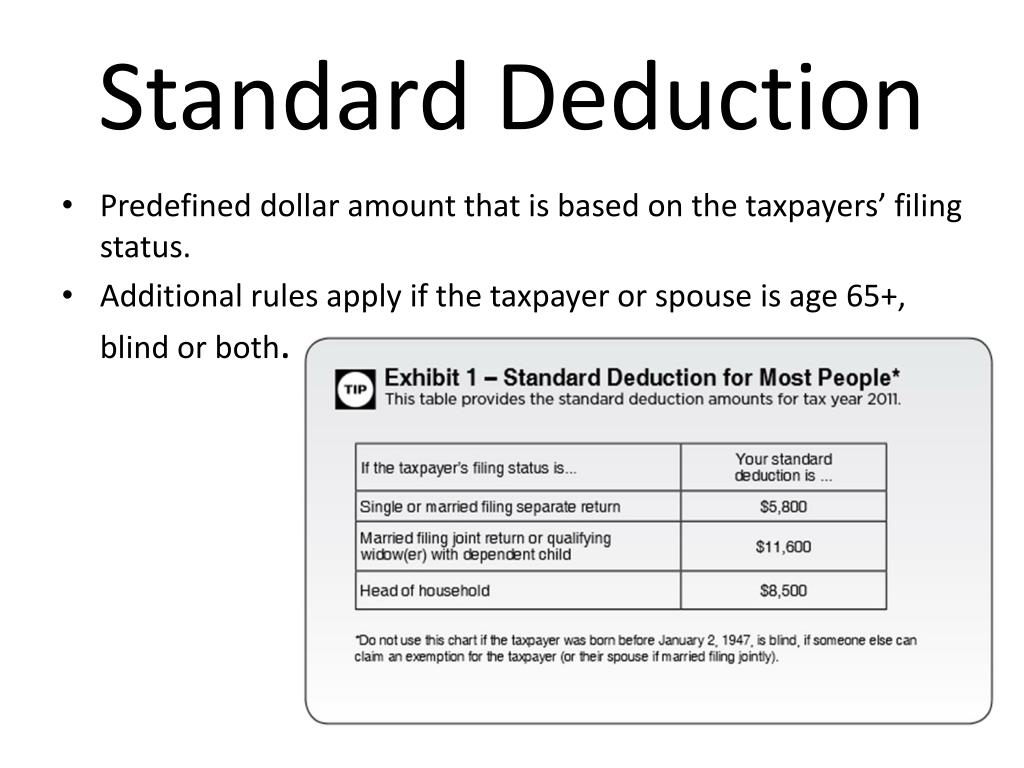

2025 Standard Deduction For Single. For single taxpayers and married individuals filing separately for tax year 2025, the standard deduction rises to $15,000 for 2025, an increase of $400 from 2025. The standard deduction will increase by $400 for single filers and by $800 for joint filers (table 2).

$15,650 for estates and trusts. The additional standard deduction for people who have reached age 65 (or who are blind) is $1,600 for each married taxpayer or $2,000 for unmarried taxpayers.

Standard Deduction For Single Taxpayers Over Age 65 In 2025 Printable, Single or married filing separately:

Taxable Brackets 2025 Manon Rubetta, There will also be changes for the standard deduction for.

Standard Deduction For Single Taxpayers Over Age 65 In 2025 Printable, The standard deduction for a dependent is limited to the greater of:

Standard Deduction For Dependents 2025 Heda Rachel, The amt exemption amount for tax year 2025 for single filers is $88,100 and begins to phase out at $626,350 (in 2025, the exemption amount for single filers was $85,700 and began to phase out.

Federal Standard Deduction For Tax Year 2025 Grata Mathilde, About 90% of taxpayers claim the standard deduction now and do not itemize.

Standard Deduction 2025 Married Jointly Single Adora Horatia, About 90% of taxpayers claim the standard deduction now and do not itemize.